The Texas Real Estate Commission is warning real estate brokers, agents and owners to be on guard after discovering the most extensive wave of leasing fraud it has investigated in recent history, all of it centered in Houston so far.

The scams involve the use of fraudulent information, such as job history and credit reports, to secure rental properties on behalf of tenants. And unlike other recent scams to defraud landlords, brokers and agents are taking part in the deception in these cases.

TREC has already investigated dozens of cases and imposed punishments, including the revocation of sales agents’ licenses and administrative penalties. In the cases outlined by the organization, agents submitted false information on behalf of tenants, at least sometimes using names and identifying information that differed from the person actually moving into a unit.

Though TREC only deals with single-family rental fraud, a similar issue has arisen at commercial multifamily properties across the nation, hitting both high-profile commercial real estate investment trusts and people. Last year, Camden Property Trust CEO Ric Campo’s identity was stolen to rent an apartment in Chicago, causing his credit score to plummet.

Renters in places like Atlanta are using social media platforms including TikTok and X, the platform once known as Twitter, to learn how to live rent-free by applying with false information and permanently leaving the rental in the middle of the night before they face consequences, Bisnow previously reported.

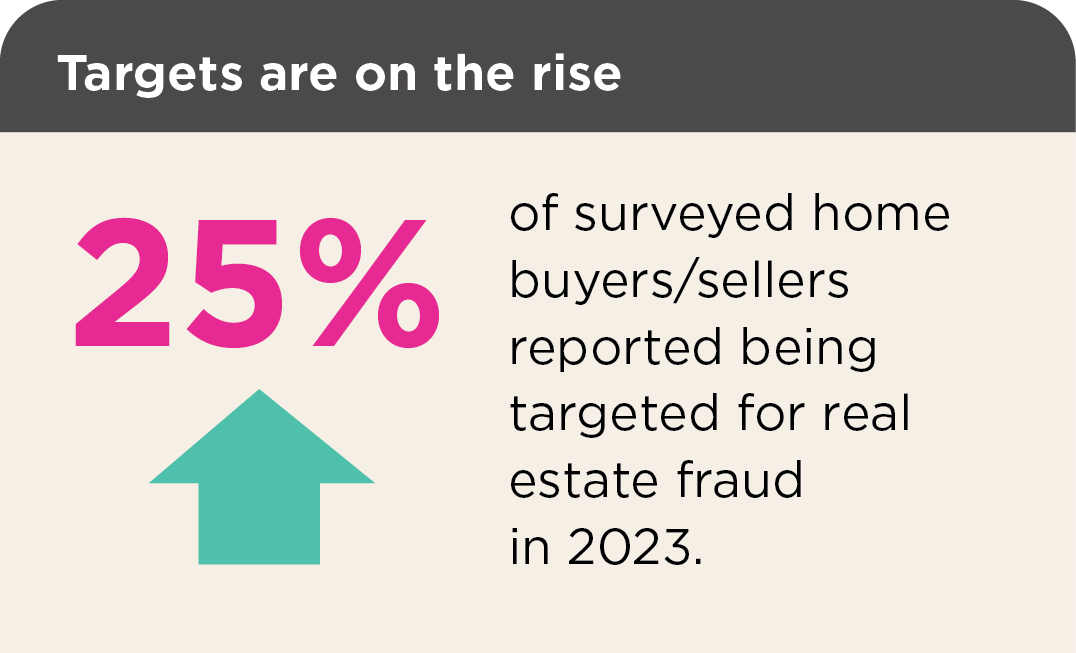

As of January, more than 70% of major apartment landlords had seen an increase in fraudulent rental applications in the previous 12 months.

That kind of fraud likely goes hand-in-hand with what TREC is seeing in Houston, and for some of the same reasons, TREC Enforcement Director Michael Molloy told Bisnow.

“Why we saw this trend happening is probably due to economic factors,” Molloy said. “The pandemic increased rental rates, with inflation and then the lack of affordable housing … People were in need of housing and this type of fraud came more to the forefront.”

TREC must rely on reports of fraud to start investigating, so it is on a significant delay, TREC Chief Investigator Roy Minton said. The activity the commission is warning about now began ramping up in 2019 and 2020, he said.

“I was surprised, as we got into this, that it was more extensive than anything I’d seen in my 11 years at TREC,” Minton said.

In one case TREC investigated, a Houston broker sponsored three sales agents who submitted fraudulent lease applications for at least 24 single-family homes between May 2022 and September 2022, according to a news release. After each lease was executed, someone other than the applicant moved into the property.

The broker in that case was formally reprimanded and fined $1K, while two agents had their licenses revoked and had to separately pay fines of $31K and $26.5K. A third agent’s license was placed on probated suspension, the release states.

It is a broker’s responsibility to supervise the agents who work for them as independent contractors, Molloy said. A broker is not required to view credit reports for rental applicants, as that falls under the landlord’s purview, but it’s good for everyone to be aware of the recent fraud and know what to look for, he said.

“We had these credit reports where the name of the applicant and the credit score was just in a slightly different font than the rest of the document,” Minton said. “So the agent representing the property owner could be more alert to look for those things.”

Brokers should meet with their agents to let them know what has been happening and advise them on best practices, he said. And though it can be difficult to step up and report suspected fraud, especially because TREC does not accept anonymous complaints, it’s important to do so to get bad actors out of the industry, Molloy said.

While it’s possible that a small circle of individuals carried out these scams, it’s hard to know without more reports and awareness, Molloy said.

“That’s why we want to get the information out there to see if there’s any more people participating in this, to encourage individuals to file complaints so that we can look into it,” he said.

For landlords that only own one rental house, this kind of fraud can be devastating, Minton said.

“Very commonly, you end up in a situation where rent is not paid for months, and the owner has to go through an eviction process,” he said. “By the time they get control of their house back, in many cases that I investigated, there was damage.”