Introduction

As an industry, real estate is especially vulnerable to fraud. Through public records and the MLS, property data is readily accessible leaving genuinely available properties vulnerable to “seller impersonation fraud”. This presents the obvious danger of robbing renters of their money, minds, and shelter, and is incredibly damaging for a property rental business. With bogus listings effectively competing against their legitimate twins, income stolen from potential tenants is likewise stolen from the impersonated property. In the aftermath of a scam, there’s legal action to contend with, a sullied reputation to repair, and time taken away from finding the tenants you need.

Other criminal opportunities come from would-be tenants in various forms of identity fraud. Everyone, regardless of moral code and ethics, needs somewhere to live – and sometimes they scheme their way in. This article highlights the dangers of seller impersonation fraud to rental property owners, including the telltale signs, trusted studies and statistics, preventative measures and solutions.

The Seller/Renter Impersonation Scheme

The hard work for these bad actors is already done, between public records, the MLS, and property owners paying top-dollar for stunning, screen-shottable photographs. Tack on the convenience of working from home and the allure of high-yield transactions posing as deposits and applicant fees, and it’s no wonder “seller impersonation fraud” has become so common that the Secret Service Cybercrime Unit issued this advisory warning in 2023 – and the alerts are still sounding.

With seller impersonation fraud the main focus for the authorities, scams regarding rentals and pocket listings fly further under the radar. As far as scams go, unfortunately, FSBO and renter impersonation fraud is quite easy to pull off. Electronic communication is the convenient norm. Posting listings across several platforms is the norm too, disguising an “additional” Craigslist or Facebook Marketplace listing as due diligence and wide coverage. Rental application fees and deposits are common enough to not raise suspicion, as every property owner gets to make their own rules, to a certain degree.

Some common warning signs of these scams are too-good-to-be-true listing prices for bait,

The Stats and Studies

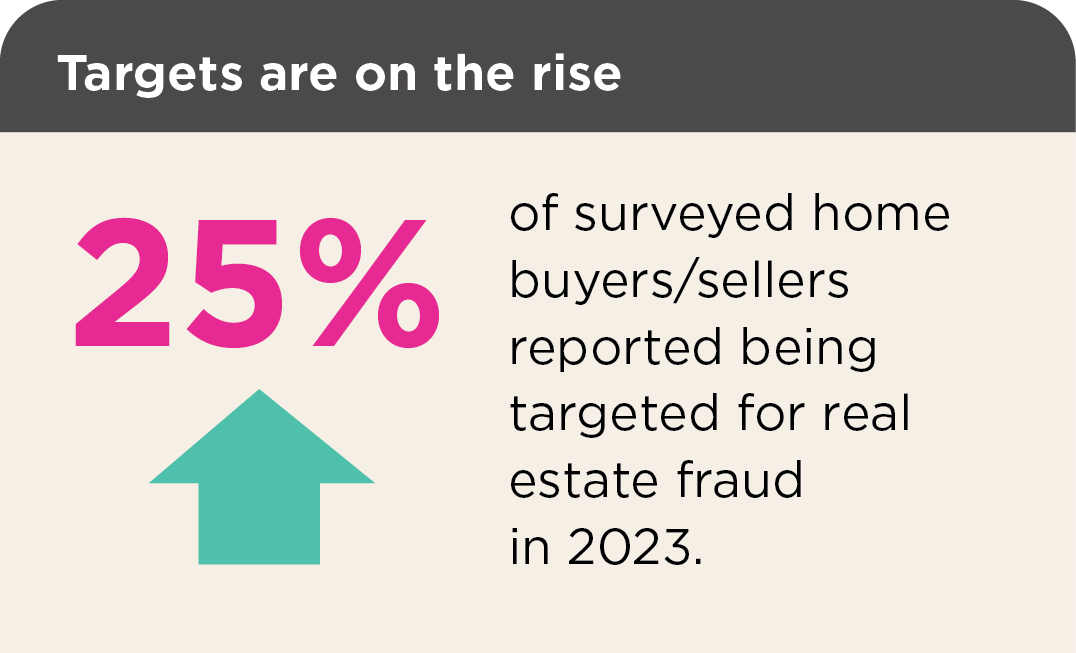

Cybercrime in real estate transactions is one of the fastest growing crimes in the U.S. Multiple recent studies and consumer reports have been published on these cases, how they’re reported and investigated, and how devastating the consequences can be. As with all scams, one of the most unfortunate issues is a lack of reporting. And the most infuriating issue is that scammers know this. Similar fraudulent crimes have gone drastically underreported in the rental space, but in light of new surveys and studies – more information on how this relates to multifamily housing and rental properties can be found here.

Here are some of the results from recent consumer reports and federal investigations regarding fraud in selling real estate:

- Only 3% of reported seller impersonation cases are accepted in the courts.

- Only 18% of stolen funds are recovered from seller impersonation scams.

- 25% of surveyed home buyers/sellers reported being targeted for real estate fraud in 2023.

- 5% of surveyed home buyers/sellers suffered losses to real estate fraud in the past three years.

- The median amount lost per victim exceeded $70K, whether it was buyers who lost down payments or sellers who lost their net proceeds.

- 22% of fraudulent communication in seller impersonation scams falsify real estate agents’ emails.

- The FBI reported “business email compromise in real estate” impacted a total of 2,284 victims in 2022, resulting in $446 million in losses.

- 60% of consumers report receiving little to no education regarding real estate fraud from their agents, title agencies, or attorney, according to surveys done by CertifID.

- Failing to adequately warn clients of the possibility of scams is grounds for a lawsuit. In the 2018 case, Bain v. Platinum Realty, LLC, a Kansas court found a real estate agent and her brokerage liable after the buyer/plaintiff was sent false wire instructions appearing to come from the selling agent/defendant. The buyer lost $196,622. The jury and federal court ordered the brokerage 85% liable and repaid $167,129.

The Solutions

Identity verification prior to tours and applications is paramount to the security of your listing(s) and the people involved with managing them.

- Biometric Identity Verification is one of the only ways to stay ahead of fraud prior to property tours. Real-time facial recognition checked against an official photographic form of ID is a stalwart guard against identity theft. “Tenant Screening” provided by most listing services cannot be considered fraud mitigation without identity verification.

- Self-Tour-based platforms additionally offer traditional, guided tours, but with the amplified security protocols required to facilitate Self-Tours. For example, an official form of photo ID must be provided and must match a selfie captured in realtime in order to create a working profile on the InstaShow app. With background checks passed and verified photo ID on file, users then face these facial recognition tests at the beginning of every scheduled tour.

Use property monitoring services and devices.

- Often provided for free, check your county recorder’s office to see if they offer property monitoring to be alerted of any suspected fraud in advance.

- Utilize search engine alerts such as Google Alerts to automate mentions of your address to be sent to your email.

- Security cameras that offer constant surveillance are a baseline form of security. When paired to your property showing software, additional disturbance notifications and facilitated 2-way communication boosts security during tours and afterwards.

- Keep a “chain of custody” record, storing timestamps and identity information when locked doors are accessed. This documentation functions to help property managers track tour statistics, track the comings and goings of maintenance crews, and functions as airtight evidence in court. Modeled after police protocol for entering evidence lockers, the InstaShow application retains a chain-of-custody log automatically for each property.

Be on the lookout for your listing(s). Everyone thinks it won’t happen to them.

- Regularly search for your listing on Craigslist and Facebook Marketplace. Just because your property has been filled, doesn’t mean scammers stop peddling the fake one; search your properties occasionally even when they aren’t on the market.

- Image search your main property photo for two reasons: First, it casts a wider net to locate fake websites or posts on other platforms. Second, Facebook Marketplace only scratches the surface of scams on Facebook. Posts (with or without images) in public Facebook groups, such as local FSBO or rental groups, will appear in search engine results.

If you find evidence of a scam, first record everything.

Take screenshots in case the page or post is taken down. File a fraud report immediately with local and state law enforcement and the FBI at IC3.gov. It is not advised to reach out to the scammer, as it could alert them to the risk of being discovered and cause them to hide evidence, or instigate further danger and criminal behavior.

If a victim shows up thinking it’s move-in day, be kind

It’s probably one of the worst days of their lives.

Citations

CertifID. 2024 State of Wire Fraud Report. (2024). https://www.certifid.com/state-of-wire-fraud

Dittman Tracey, Melissa. Consumers: Agents aren’t warning us enough about scams. (2024, March 6). https://www.nar.realtor/magazine/real-estate-news/technology/consumers-agents-arent-warning-us-enough-about-scams#:~:text=Scams%20Are%20Rising%3A%201%20in,consumers%20became%20victims%20last%20year.

Han, B., & Han, B. (2024, February 5). Consumer education at the center of wire fraud mitigation efforts. HousingWire. https://www.housingwire.com/articles/consumer-education-at-the-center-of-wire-fraud-mitigation-efforts/

Tomb, Diane. With fewer sellers on the housing market, more scammers are impersonating them. (2023, September 22). Fortune. https://fortune.com/2023/09/22/fewer-sellers-housing-market-scammers-impersonating-fraud-real-estate-diane-tomb/

United States District Court of Kansas citation: See Bain v. Platinum Realty, LLC. (2018) https://ecf.ksd.uscourts.gov/cgi-bin/show_public_doc?2016cv2326-132United States Secret Service Cybercrime Investigations. (2023). Real estate scams. https://www.alta.org/file?name=Seller-Impersonation-Fraud

Conclusion.

Combating real estate scams demands a proactive approach centered on robust security measures and preventative strategies. Implementing biometric identity verification enhances protection against fraudsters, safeguarding assets and preventing financial ruin. By prioritizing these steps now and monitoring listings, property owners can significantly reduce the risk of falling victim to fraudulent activities.

Source: https://instashow.app/listing-scams/?utm_medium=email&utm_source=rasa_io&utm_campaign=newsletter